On August 5, the Ministry of Industry and Information Technology (MIIT) announced on its official website the final review of the liquidation and approval of subsidies for the promotion and application of new energy vehicles from 2016 to 2020, as well as the advance allocation of subsidies for 2021 to 2022. The total amount of subsidies for the promotion and application of new energy vehicles from 2016 to 2020 reached 1.6546 trillion yuan, with 167.89 million yuan allocated for 2021 to 2022.

1.65 billion yuan in subsidies issued from 2016 to 2020

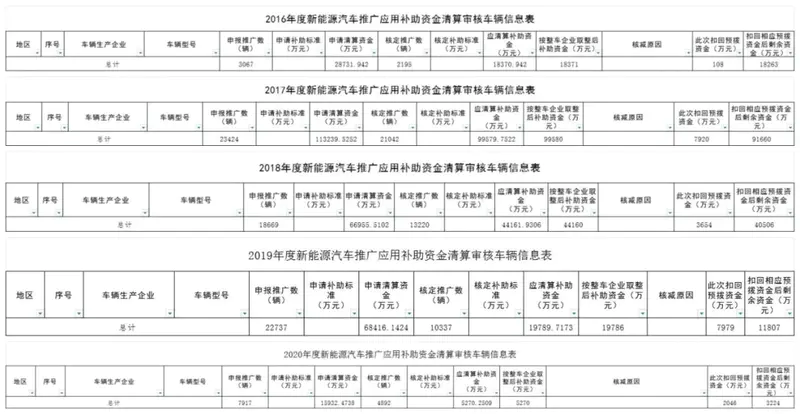

The results of the liquidation and audit show that the total pre-allocated funds for subsidies for the promotion and application of new energy vehicles from 2016 to 2020 were 217.07 million yuan, and the total accounting amount reached 165.46 million yuan.

Among them, 872 vehicles applying for subsidies were reduced in 2016, requiring the withdrawal of 1.08 million yuan in pre-allocated funds, and 182.63 million vehicles were issued subsidies in 2016;

In 2017, 2,382 vehicles applying for subsidies were reduced, requiring the withdrawal of 79.2 million yuan in pre-allocated funds. In 2017, 916.6 million yuan in subsidies were issued.

In 2018, 5,449 vehicles applying for subsidies were reduced, requiring the withdrawal of 36.54 million yuan in pre-allocated funds. In 2018, 405.06 million yuan in subsidies were issued.

In 2019, 12,400 vehicles applying for subsidies were reduced, requiring the withdrawal of 79.79 million yuan in pre-allocated funds, and 118.07 million yuan in subsidies were issued in 2019;

In 2020, the number of vehicles applying for subsidies was reduced by 3,025, and 20.46 million yuan of pre-allocated funds needed to be deducted. A total of 32.24 million yuan in subsidies were issued in 2020.

Judging from the public information, the main reasons why vehicles failed to pass the subsidy liquidation are that the relevant certificates did not meet the liquidation declaration requirements, the vehicle registration information was incorrect, the vehicle commissioning time did not meet the requirements, the vehicle mileage did not meet the requirements, the on-site inspection failed, the battery cell model (energy density) was inconsistent with the recommended catalog, and the vehicle operation data was not uploaded as required. There were also vehicles whose subsidies were deducted because the commissioning time did not meet the requirements, the vehicle registration date was earlier than the catalog effective date, the vehicle registration date was not within the policy validity period, etc. There were even problems with repeated declarations (applications) for some vehicles.

167.89 million yuan in advance funds for 2021-2022

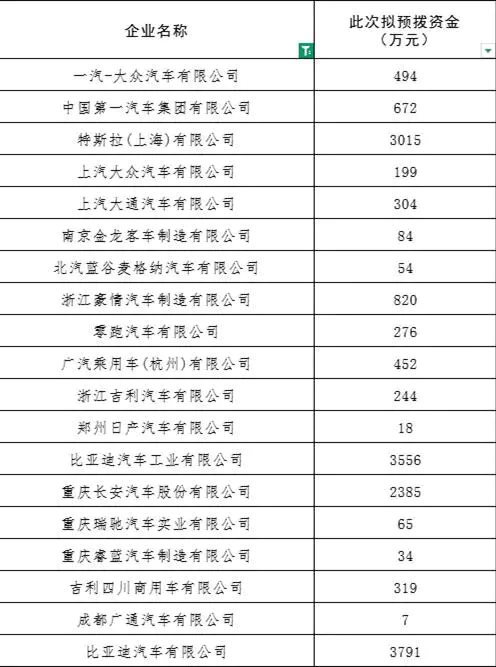

According to statistics, 167.89 million yuan in subsidy funds for the promotion and application of new energy vehicles in 2021-2022 have been allocated in advance, involving 19 companies in 10 provinces and cities.

Among them, Shaanxi, Shenzhen, and Shanghai received the highest amount of subsidies, all exceeding 30 million yuan, namely 37.91 million yuan, 35.56 million yuan, and 35.18 million yuan respectively. These three provinces and cities are also the provinces and cities with the highest production of new energy vehicles in my country in 2021-2022.

Among companies, BYD received the most subsidies. BYD Auto Co., Ltd. in Shaanxi and BYD Auto Industry Co., Ltd. in Shenzhen received 37.91 million yuan and 35.56 million yuan, respectively. Tesla (Shanghai) Co., Ltd. in Shanghai received 30.15 million yuan, ranking second among automakers. In 2021-2022, BYD and Tesla's new energy vehicle production far exceeded that of other companies, naturally resulting in more subsidies. BYD, in particular, saw rapid growth in production in both Shaanxi and Shenzhen, securing a significant market share and receiving substantial subsidy support.

It is worth noting that traditional car companies will still dominate the subsidies for 2021-2022, and joint venture car companies such as FAW-Volkswagen, SAIC Volkswagen, and SAIC Maxus will also receive subsidies of millions of yuan; among the new car-making forces, only Leapmotor appears in the pre-allocated funds table this time, which also shows to a certain extent that in 2021-2022, the market promotion of new energy vehicles will still be dominated by traditional car companies, and the share of new car-making forces will still be relatively small.

The subsidy funds allocated in 2021-2022 will still be mainly for passenger cars. For commercial vehicles, only Nanjing Golden Dragon and Geely Sichuan Commercial Vehicle Co., Ltd. will be allocated. In 2021-2022, the market promotion of new energy commercial vehicles will still be relatively slow.

The liquidation and advance payment of new energy vehicle subsidy funds announced this time reflect the trend of precision and standardization of subsidy policies. Stricter review has become the norm, urging companies to continuously improve their technical compliance, data transparency and operational management.

In fact, China's new energy vehicle industry has significantly reduced its reliance on subsidies. Data from the China Association of Automobile Manufacturers shows that from January to June 2025, new energy vehicle production and sales reached 6.968 million and 6.937 million units, respectively, representing year-on-year growth of 41.4% and 40.3%, respectively, with a penetration rate of 44.3%. These impressive figures further demonstrate that even after the subsidy reduction, the industry has achieved self-sustaining growth, and China's new energy vehicle industry is transitioning from subsidy-based support to a mature, market-driven stage.